*This is the first of a series of blog posts that will help you understand some of the key economics topics and the impact they have on our day to day lives

The Bank of England is the UK’s central bank. The job of the bank is to maintain an inflation rate of 2%. The biggest thing the UK central bank can do to slow the rate of inflation and stop prices from growing so quickly is to raise interest rates.

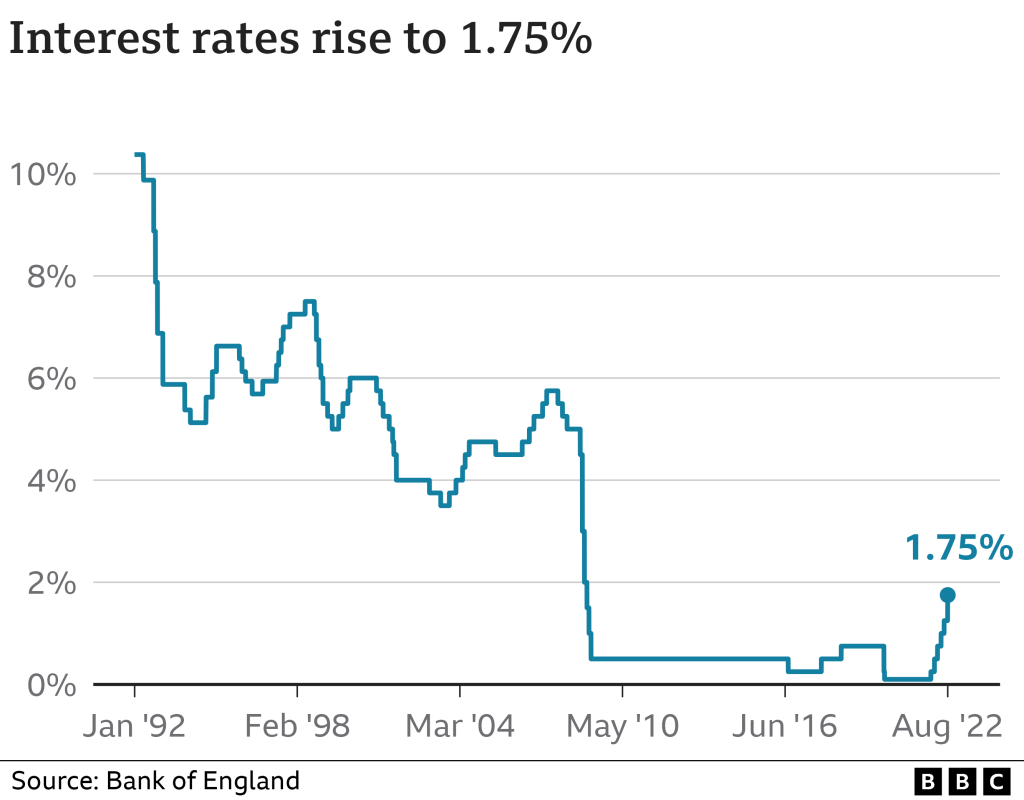

The Bank Rate, the main interest rate in the UK, is decided by the bank. Since December, the bank has gradually increased the Bank Rate. As part of the August report they increased it to 1.75%. All other rates in the UK, such as those you would have for a loan, mortgage, or savings account, are affected by this.

Cost-push inflation

The majority of inflation that is occurring today is cost-push inflation. This occurs when prices rise due to higher costs of production. It is determined by supply-side factors, here are some examples:

- Higher price of Commodities – a rise in the price of commodities would lead to higher production costs. Higher oil prices would lead to higher transport costs and a higher cost of production.

- Higher wages – wages are one of the main costs of production. When wages rise, the costs of production rise and there is more cost-push inflation.

Why is inflation so high?

The war in Ukraine is a major factor in today’s rising prices. As a result of Russia’s invasion of Ukraine, gas has become less accessible and this has led to large price increases.

Increased costs for the items we import from other countries have also been a significant factor. During the Pandemic, people saved a lot of money as they were not able to go out and spend as often. Consumption rose when restrictions were lifted and because of those savings. However, suppliers have had problems getting enough goods to sell to consumers; this has led to higher prices.

Price increases are also a result of happenings in the UK. The prices of goods are rising because businesses are facing higher costs of production. As fewer people are looking for work since the pandemic, there are more job vacancies than there are workers to fill them. This is resulting in wage inflation and the prices for many services have risen.

How high will interest rates go?

It is hard to say how high interest rates will go but it will solely depend on the state of the economy in the run up to the next monetary policy committee meeting.

If businesses continue to raise their prices and workers demand wage increases to keep up with the price increases, then inflation will continue to rise and interest rates will have to rise.

The action of raising/lowering interest rates to deal with inflation is called monetary policy – i will explain this topic in my next blog post.

Footnotes:

https://www.bankofengland.co.uk/knowledgebank/why-are-interest-rates-in-the-uk-going-up